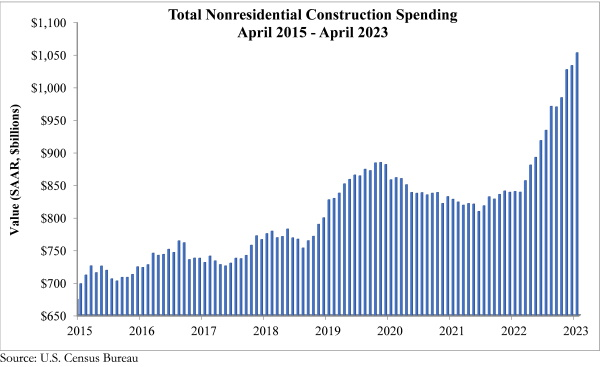

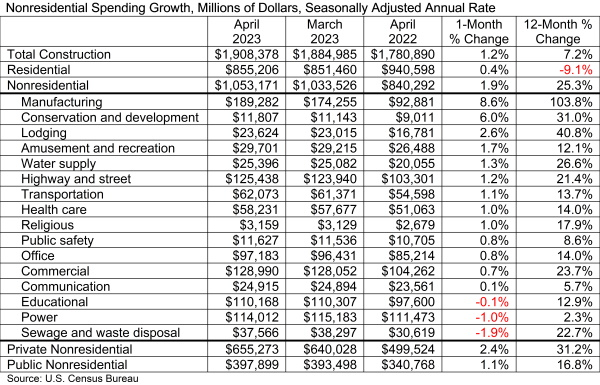

National nonresidential construction spending expanded 1.9% in April, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.05 trillion.

Spending strength was broad-based, rising in 13 of the 16 nonresidential subcategories on a monthly basis. Private nonresidential spending was up 2.4% in April, while public nonresidential construction spending was up 1.1%.

“What recession?” said ABC Chief Economist Anirban Basu. “Despite a slew of headwinds, including higher interest rates, prominent bank failures, a near-miss debt ceiling crisis and pervasive fears of recession, money continues to flow into the U.S. nonresidential construction segment. Manufacturing-related construction spending growth continues to lead the way, but even segments that had been weak such as lodging are picking up steam.

“Contractors continue to complain about labor and skills shortages in the context of strong demand for their services,” said Basu. “It appears that the optimism that ABC contractors have been expressing about their prospects is proving justified. Backlog is stable and there is still evidence of significant pricing power, helping to support contractor profit margins. Moreover, public construction spending stands to remain strong even if the economy enters recession later this year, with considerable sums of money lined up to drive road, bridge and other work during the years ahead.

“While 2023 appears to be a solid year of growth for the nonresidential construction industry, 2024 remains far less certain,” said Basu. “The combined impacts of growing weakness in consumer spending, tightening credit conditions, lag effects associated with prior Federal Reserve rate increases and uncertainty stemming from high-stakes elections could eventually catch up to the broader economy and certain construction segments.”