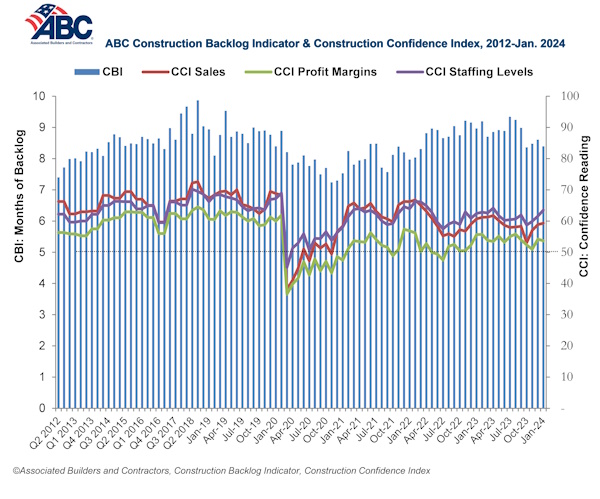

Associated Builders and Contractors reported today that its Construction Backlog Indicator declined to 8.4 months in January, according to an ABC member survey conducted from Jan. 22 to Feb. 4. The reading is down 0.6 months from January 2023.

View ABC’s Construction Backlog Indicator and Construction Confidence Index tables for January. View the full Construction Backlog Indicator and Construction Confidence Index data series.

Backlog increased to 10.9 months in the heavy industrial category, the highest reading on record for that category, and is 2.5 months higher than in January 2023. Backlog is down on a year-over-year basis in the commercial/institutional and infrastructure categories.

ABC’s Construction Confidence Index readings for sales and staffing levels increased in January, while the reading for profit margins declined. All three readings remain above the threshold of 50, indicating expectations for growth over the next six months.

“As predicted, performance in the nonresidential construction sector is becoming more disparate across segments,” said ABC Chief Economist Anirban Basu. “For much of the pandemic recovery period, contractors in virtually all segments were indicating stable to rising backlog. That remains the case for contractors most exposed to the nation’s industrial production. Reshoring and near-shoring continue to drive construction spending.

“In other categories, however, including those most interest rate-sensitive, activity appears to be slowing,” said Basu. “Developer financing has become both more expensive and more difficult to obtain over roughly the past year, in part because of rising office vacancy in many markets. That helps to explain declining backlog in the commercial category. The decline in infrastructure-related backlog may be due only to seasonality, however. There is every reason to believe that contractors specializing in public works will have a very busy year.”

Note: The reference months for the Construction Backlog Indicator and Construction Confidence Index data series were revised on May 12, 2020, to better reflect the survey period. CBI quantifies the previous month’s work under contract based on the latest financials available, while CCI measures contractors’ outlook for the next six months. View the methodology for both indicators.

Note: The reference months for the Construction Backlog Indicator and Construction Confidence Index data series were revised on May 12, 2020, to better reflect the survey period. CBI quantifies the previous month’s work under contract based on the latest financials available, while CCI measures contractors’ outlook for the next six months. View the methodology for both indicators.